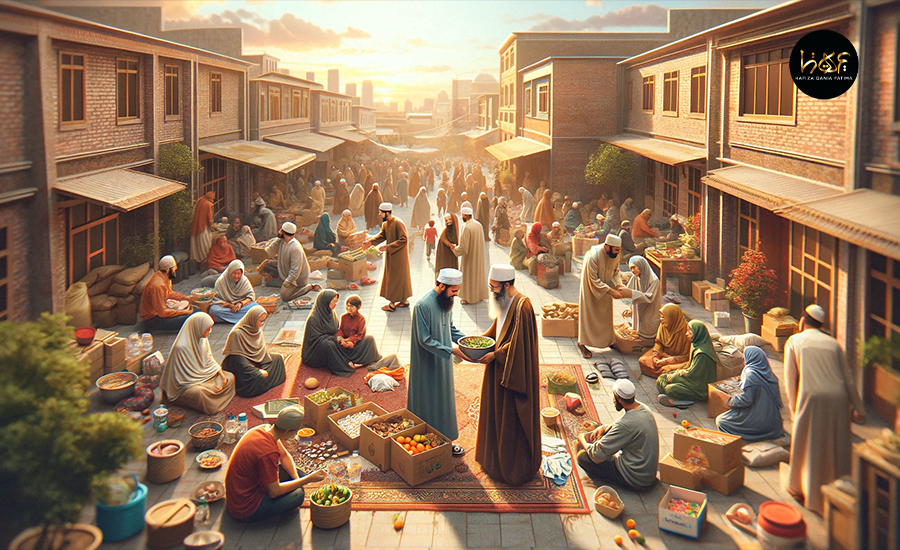

Dear Islamic brothers, in this comprehensive exploration, we aim to fully understand “What is Zakat in Islam” and clarify “how much zakat to pay.” Delving into this vital Islamic pillar, we will discuss its significance, its status as a mandatory act (Fard), its precise definition, the implications of denying its obligation, and the consequences of non-fulfillment. Drawing from the rich tapestry of Quranic verses, Hadiths, and scholarly Islamic texts, our journey is intended to deepen our knowledge and reinforce our commitment to this key aspect of our faith, enhancing our spiritual and communal bonds.

Understanding Zakat in Islam: Its Importance

Zakat stands as a crucial pillar in Islam, symbolizing much more than mere charity. It is a divine commandment for the purification of wealth and an integral part of social responsibility. Its significance is repeatedly highlighted in the Quran, particularly in Surah Al-Baqarah, verse 43 (وَ اَقِیْمُوا الصَّلٰوةَ وَ اٰتُوا الزَّكٰوةَ), where Zakat and Salah are mentioned together, underscoring their spiritual and societal importance. This coupling in the Quran points towards a balance between personal devotion and social welfare, a core principle in Islamic teachings.

When Did Zakat in Islam Become Mandatory?

Declared mandatory (Fard) in the 2nd Hijri, Zakat’s establishment marked a significant milestone in Islamic jurisprudence. The Prophet Muhammad (صَلَّی اللہُ تَعَالٰی عَلَیْہِ وَاٰلِہٖ وَسَلَّمَ) asserted its importance as a fundamental pillar, as recorded in Sahih Bukhari (Kitab ul Iman). This historic declaration highlights Zakat’s indispensable role in the foundation of Islamic practice and its continued relevance in Muslim society.

How Much Zakat to Pay in Islam

Defined by Islamic Shari’ah, Zakat requires the relinquishment of a specific portion of wealth solely for the pleasure of Allah (عَزَّ وَجَلَّ). According to Durr e Mukhtar (Kitabuzakat), it involves transferring ownership of wealth to a qualified Muslim Faqeer not related to the Hashmi family or a freed Hashmi slave. The phrase “how much zakat to pay” pertains to giving 2.5% (or 1/40th) of one’s savings and assets exceeding the Nisab, as detailed in Bahar e Shariat. This calculation represents a modest yet significant contribution, ensuring everyone capable contributes to communal welfare.

Who Must Pay Zakat? Islamic Guidelines

The obligation of Zakat falls upon every sane, adult Muslim meeting specific conditions, ensuring fairness and equity. These conditions, as delineated in Bahar e Shariat, include the ownership of wealth above the Nisab threshold, its growth nature, and its excess over debts and essential needs. This criterion ensures that Zakat is paid by those who are financially able, reinforcing the Islamic principle of communal support and responsibility.

Consequences in Islam for Denying Zakat

Refusing to acknowledge or pay Zakat is seen as a serious violation in Islam. Various Hadiths describe the severe repercussions of ignoring this duty. These include texts from Majma-ul-Zwaed (KitabulZakat) and Shob-ul-Iman, covering impacts in this life and the hereafter. This grave sin is not taken lightly, as it undermines one of the fundamental pillars of Islam and disrupts the social and moral order prescribed in Islamic teachings.

What Happens if You Don’t Pay Zakat in Islam?

The consequences of neglecting Zakat transcend spiritual realms, affecting worldly affairs. As Ibn-e-Majah narrates, withholding Zakat leads to a cessation of blessings, symbolized by the absence of rain. This metaphor illustrates the broader impact of non-compliance on the community. It emphasizes that failing to fulfill this obligation can lead to societal hardships. This concept reinforces the notion that individual actions have communal consequences, a key principle in Islamic ethics.

Conclusion

In summarizing the profound significance of Zakat in Islam, it is clear that this pillar is not merely a financial obligation but a transformative act of faith, deeply rooted in Islamic teachings. As we have explored, several aspects are crucial in this divine commandment. These include knowing how much zakat to pay, understanding its calculation, and recognizing the eligible recipients. The Holy Quran and Hadiths emphasize Zakat’s role in purifying wealth and fostering communal solidarity. May Allah (عَزَّ وَجَلَّ) guide us to fulfill this duty with sincerity, contributing to the well-being of the Ummah and adhering to the path of righteousness. Let us embrace the responsibility of Zakat, ensuring its timely and correct implementation as an expression of our devotion and service to Allah (عَزَّ وَجَلَّ) and His creation.

FAQs:

Q: What is Zakat in Islam?

A: Zakat in Islam is a mandatory act of charity and one of the five pillars. It entails giving a fixed portion of one’s wealth to those in need. It serves not only as a financial obligation but also as a means to purify one’s wealth. Additionally, it ensures economic balance in the Muslim community. The Holy Quran and Hadith repeatedly underscore its significance.

Q: How Much Zakat to Pay?

A: Typically, you should pay 1/40th part of the Nisab as Zakat, which equates to 2.5% of your eligible wealth. This rate is applicable to the sum of savings and assets exceeding the Nisab threshold. These should have been under one’s ownership for the duration of a lunar year.

Q: How to Calculate Zakat?

A: To calculate Zakat, an individual must initially ascertain whether their wealth surpasses the Nisab threshold. This threshold is the minimum wealth amount required for Zakat liability. Then, give 2.5% of the total wealth, including cash, savings, gold, silver, and business commodities, as Zakat.

Q: Who is Eligible for Zakat?

A: Zakat is a mandatory obligation for every sane, adult Muslim, who is not a slave. It applies to those owning wealth above the Nisab threshold, maintained throughout a complete lunar year. The wealth should be over and above one’s debts and basic necessities of life.

Q: When to Pay Zakat?

A: Muslims should pay Zakat after their wealth exceeds the Nisab threshold for one lunar year (Hijri year). Zakat is a yearly obligation. Its payment timing differs individually, based on when one’s wealth reaches or surpasses the Nisab.

Source:

Dawat e Islami